Gold and silver are not new to people. Long before stock markets and digital money, people

trusted these metals to protect their savings. Even today, when prices of daily things keep

going up and money feels less powerful, people naturally look at gold and silver again.

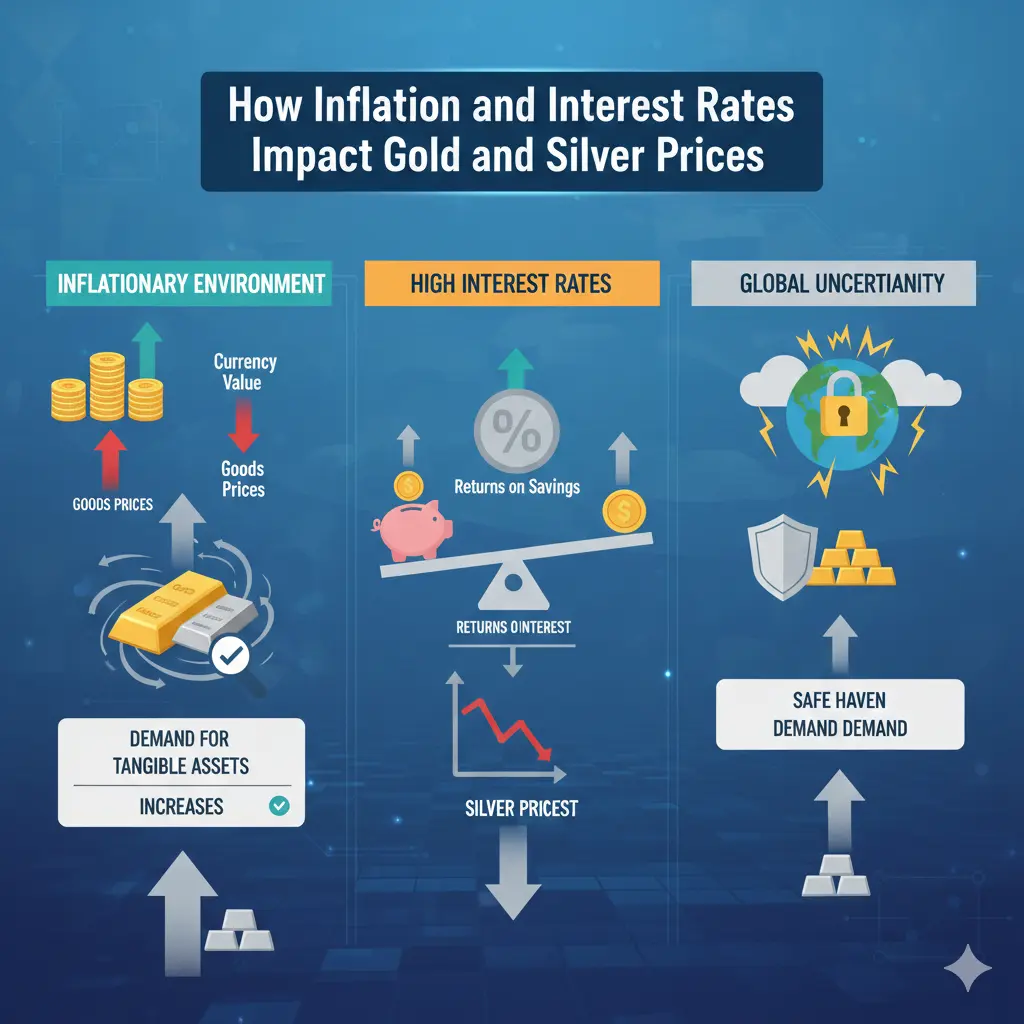

Inflation simply means everything becomes more expensive. Groceries, fuel, rent, all start

costing more. At that time, people feel worried about their savings losing value. Gold

becomes attractive because its supply cannot be increased easily. No government can print

gold the way they print money. That is why, during high inflation, many people buy gold to

feel safe.

Silver also becomes popular, but for different reasons. It is not just a precious metal. It is used

in factories, electronics, solar panels, and many industries. So when the economy is active,

silver demand rises. When people are scared, silver still gets attention, but its price moves

faster and more sharply than gold.

Interest rates play an important role here. When interest rates are low, bank savings and fixed

deposits do not give good returns. At that time, holding gold or silver feels like a better

choice. But when interest rates go up, banks and bonds start giving higher returns. Then many

people prefer interest-earning options instead of gold and silver, because these metals do not

give regular income.

Still, the market is not run only by logic. News, fear, wars, political tension, or sudden

economic trouble can change everything overnight. In such moments, people rush back to

gold and silver, no matter what interest rates are.

In simple words, gold and silver move with human emotions. Fear, trust, and uncertainty

decide their value as much as numbers do.

24

Jan